Statutory and contractual restrictions are called retained earnings. – Statutory and contractual restrictions are called retained earnings, and they represent limitations imposed on a company’s ability to use its retained earnings. These restrictions can arise from various sources, including laws, regulations, and contractual agreements, and they can have a significant impact on a company’s financial flexibility and the availability of retained earnings for investment and other purposes.

Statutory restrictions on retained earnings are imposed by law and typically aim to protect the interests of creditors and other stakeholders. Contractual restrictions, on the other hand, are imposed by agreements between a company and its lenders or other parties and can serve various purposes, such as ensuring compliance with loan covenants or protecting the interests of minority shareholders.

Statutory Restrictions

Statutory restrictions are limitations imposed by law on the use of retained earnings. These restrictions are typically intended to protect creditors, minority shareholders, and other stakeholders by ensuring that a company maintains a certain level of financial stability.

Examples of statutory restrictions include:

- Restrictions on the payment of dividends

- Restrictions on the repurchase of shares

- Restrictions on the issuance of new debt

Statutory restrictions can have a significant impact on retained earnings. For example, a company that is prohibited from paying dividends may be forced to retain more earnings than it would otherwise need. This can lead to a reduction in the company’s financial flexibility and may make it more difficult to attract investors.

The legal and regulatory implications of statutory restrictions are complex and vary from jurisdiction to jurisdiction. It is important for companies to be aware of the statutory restrictions that apply to them and to comply with these restrictions in order to avoid legal and financial penalties.

Contractual Restrictions

Contractual restrictions are limitations on the use of retained earnings that are imposed by contracts between a company and its creditors or other parties. These restrictions are typically intended to protect the interests of the creditors or other parties by ensuring that the company maintains a certain level of financial stability.

Common types of contractual restrictions include:

- Restrictions on the payment of dividends

- Restrictions on the repurchase of shares

- Restrictions on the issuance of new debt

- Restrictions on the use of retained earnings for specific purposes

Contractual restrictions differ from statutory restrictions in that they are imposed by contract rather than by law. This means that contractual restrictions can be more flexible than statutory restrictions and can be tailored to the specific needs of the parties involved.

Impact on Retained Earnings: Statutory And Contractual Restrictions Are Called Retained Earnings.

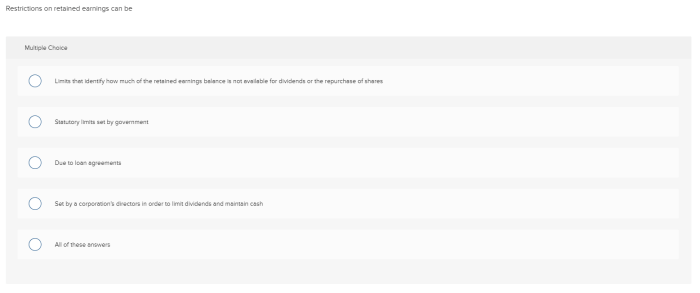

Statutory and contractual restrictions can have a significant impact on the availability of retained earnings. Restrictions on the payment of dividends, for example, can reduce the amount of cash that a company has available for distribution to shareholders. Restrictions on the repurchase of shares can make it more difficult for a company to reduce its outstanding shares and increase its earnings per share.

These restrictions can also affect the financial flexibility of a company. A company that is subject to restrictions on the issuance of new debt may find it more difficult to raise capital to fund new projects or acquisitions. A company that is subject to restrictions on the use of retained earnings for specific purposes may find it more difficult to invest in new products or technologies.

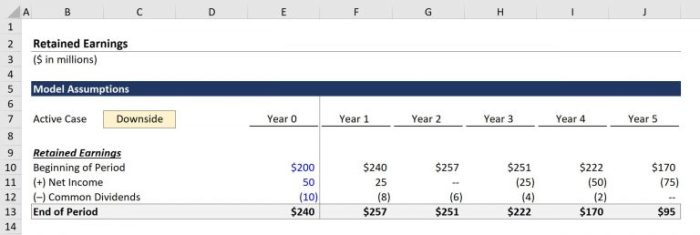

Companies can manage retained earnings under restrictions in a number of ways. One common strategy is to use retained earnings to fund internal growth projects. Another strategy is to use retained earnings to reduce debt. Companies may also use retained earnings to build up a cash reserve to meet unexpected expenses or to fund future acquisitions.

Implications for Financial Analysis

Statutory and contractual restrictions on retained earnings should be considered in financial analysis. Financial ratios and other analytical tools can be misleading if they do not take into account the impact of these restrictions.

For example, a company that is subject to restrictions on the payment of dividends may have a low dividend payout ratio. This could lead an analyst to conclude that the company is not generating enough cash to cover its dividend payments.

However, the low dividend payout ratio may simply be the result of the company’s statutory or contractual restrictions.

It is important to adjust financial statements for the impact of restrictions when performing financial analysis. This can be done by using a variety of techniques, such as:

- Adjusting the balance sheet to remove restricted retained earnings

- Adjusting the income statement to remove the impact of restricted retained earnings on earnings per share

- Adjusting the cash flow statement to remove the impact of restricted retained earnings on cash flow from operations

Disclosure and Reporting

Companies are required to disclose statutory and contractual restrictions on retained earnings in their financial statements. This disclosure is typically made in the notes to the financial statements.

The disclosure of statutory and contractual restrictions is important for investors and other stakeholders to understand the financial position of a company. This disclosure helps investors to make informed investment decisions and helps stakeholders to assess the financial health of a company.

Auditors play an important role in ensuring that companies properly disclose statutory and contractual restrictions on retained earnings. Auditors review the company’s financial statements and other documentation to ensure that the disclosure is accurate and complete.

FAQ Guide

What are the most common types of statutory restrictions on retained earnings?

Statutory restrictions on retained earnings can vary depending on the jurisdiction, but common types include restrictions related to dividend payments, capital maintenance, and the accumulation of excessive reserves.

How do contractual restrictions differ from statutory restrictions on retained earnings?

Contractual restrictions are imposed by agreements between a company and its lenders or other parties, while statutory restrictions are imposed by law. Contractual restrictions can be more flexible and tailored to the specific needs of the parties involved.

What are the implications of statutory and contractual restrictions on retained earnings for financial analysis?

Statutory and contractual restrictions on retained earnings can limit the availability of retained earnings for investment and other purposes, which can impact financial ratios and other analytical tools. Analysts need to adjust financial statements for the impact of these restrictions to obtain a more accurate assessment of a company’s financial performance.